Scenario Planning: How to Pull the Right Levers in Your Business

Scenario planning helps businesses prepare for uncertainty by testing the impact of pulling key levers such as price, volume, costs, productivity, and investment. By modelling scenarios and outcomes, leaders gain foresight, agility, and resilience, enabling smarter, confident decisions.

In a world of shifting markets, rising costs, and rapid technological change, leaders can no longer rely on static annual plans. Instead, they need tools that help them adapt. That is where strategic planning, budgeting, forecasting, and scenario planning come together. When used properly, they transform uncertainty into foresight and give businesses the confidence to act.

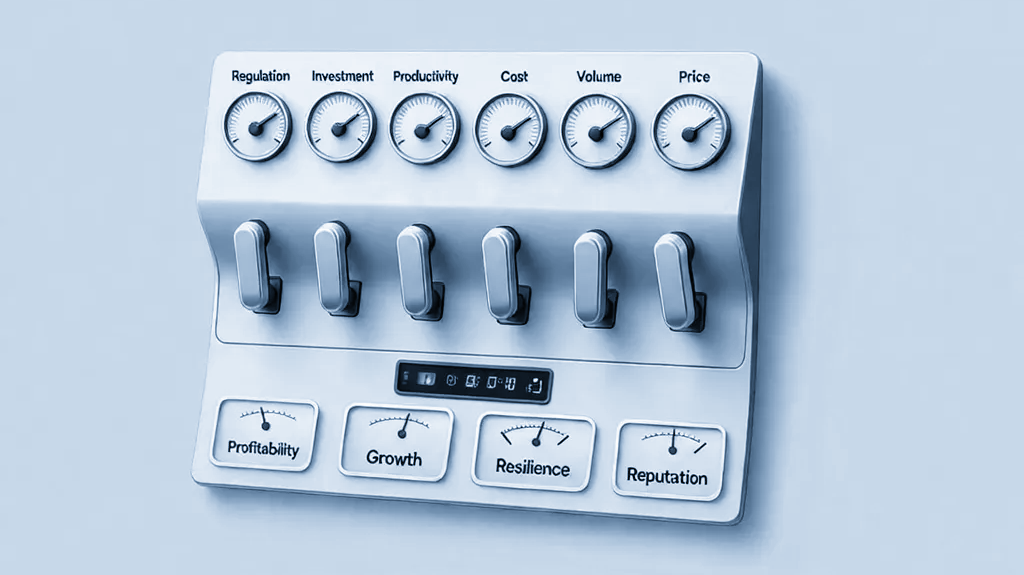

At the heart of this approach is a deceptively simple idea: your business is shaped by a set of levers. These are the controllable or semi-controllable drivers (pricing, costs, productivity, investment, and market dynamics) that most influence outcomes. By testing "what if we pull this lever?" you can anticipate not only financial results but also the wider corporate consequences.

1. The Foundation: Strategic Planning, Budgeting and Forecasting

Strategic Planning

Strategic planning sets direction. It defines where the business wants to go and how it will get there. Its key features include:

Vision and mission: Purpose and long-term goals.

Market and competitor analysis: Understanding external pressures.

SWOT assessment: Internal strengths and weaknesses versus external opportunities and threats.

Goal setting: Clear, measurable objectives.

Strategy design: Action paths that connect ambition with resources.

Budgeting

Budgeting translates strategy into a financial plan. It involves projecting revenues, allocating expenses across functions, managing cash flow, controlling costs, and reviewing performance against plan.

Forecasting

Forecasting goes further by anticipating what might happen. This includes using historical and market data, building predictive models, testing alternative scenarios, quantifying risk, and continuously updating as conditions change.

Together, these disciplines prepare you to think not just about the plan but about the range of outcomes that reality may deliver.

2. The Levers that Drive Business Outcomes

Every business has dozens of variables, but a handful of levers typically matter most. Understanding them allows leaders to focus attention where it counts.

Revenue Levers

Sales volume: More customers or units sold.

A 10% volume increase boosts turnover and scale economies, but strains operations if delivery capacity lags. A fall in volume risks idle resources and margin pressure.

Pricing: Raising or lowering price points.

A 5% price rise lifts margins if demand holds steady. However, if customers are price-sensitive, sales may dip and competitors gain ground.

Cost Levers

Input costs (COGS, materials, energy): Rising supplier prices or currency shifts.

Margins shrink unless costs are absorbed or passed through to customers. Long-term contracts or supplier diversification provide stability.

Operating expenses: Staffing, marketing, tech investment.

Cutting spend may lift short-term profit but reduce capacity for growth. Increased marketing could grow market share but erode margins if ROI is weak.

Productivity Levers

Labour efficiency: Output per employee.

Improved efficiency reduces unit costs and strengthens competitiveness. Conversely, low productivity raises wage costs and undermines resilience.

Process improvements: Automation, digitalisation, lean methods.

Faster delivery times and lower waste improve customer satisfaction and sustainability credentials.

Capital and Investment Levers

CapEx: Investment in plant, technology, or expansion.

Heavy investment accelerates growth but depletes cash if payback is delayed. Deferring CapEx preserves liquidity but risks losing market edge.

M&A and Partnerships: Acquisitions or strategic alliances.

Market share can expand quickly, but integration risks can create cultural and operational friction.

Market and External Levers

Customer behaviour shifts: New preferences, sustainability demands, digital-first habits.

Adapting quickly opens growth opportunities. Failing to respond risks erosion of brand relevance.

Regulation: Environmental rules, tax changes, labour laws.

Compliance increases costs but strengthens stakeholder trust. Non-compliance can lead to fines and reputational damage.

Macroeconomic factors: Inflation, interest rates, currency.

Rising rates increase debt costs and dampen demand. A weaker domestic currency may hurt importers but benefit exporters.

3. What Happens When You Pull the Levers?

Scenario planning is not just a numbers game. Each lever carries ripple effects that shape the business strategically and culturally, not just financially.

Pulling the price lever: You may achieve margin growth, but risk customer pushback. Profits rise short-term, yet brand perception suffers if customers feel overcharged.

Pulling the volume lever: Expanding demand can fuel growth. Revenue rises, but if service quality dips due to strain, reputation and retention may fall.

Pulling the cost lever: Cutting overheads improves profitability. Margins strengthen but morale dips, innovation slows, or customers feel the impact of lower service levels.

Pulling the productivity lever: Efficiency gains create structural advantage. Lower costs, faster delivery, and higher resilience follow, but this requires upfront investment and workforce change management.

Pulling the CapEx lever: Investment drives growth. Future competitiveness rises, but financial risk increases if markets shift unexpectedly.

Pulling the regulatory lever: Compliance investments build trust. Short-term costs rise but long-term licence to operate and brand reputation improve.

By mapping likely outcomes, leaders can decide not only what lever to pull, but when and how far.

4. From Insight to Value

When scenario planning is embedded into strategy, the benefits are significant:

Sharper foresight: Anticipate external shocks and internal bottlenecks.

Agility: Pivot quickly when assumptions prove wrong.

Resilience: Prepare financial buffers and operational contingencies.

Stronger trust: Build credibility with investors, employees, and customers by delivering consistently.

Smarter growth: Allocate resources to where the return is greatest, with risks understood.

5. The Role of Generative AI

Generative AI takes this a step further by analysing huge datasets to uncover hidden trends, generating multiple "what-if" scenarios simultaneously, predicting demand shifts from external signals (such as social sentiment, competitor pricing, and macro data), and creating dynamic dashboards that update forecasts in real time.

Instead of relying on quarterly reviews or annual budgets, AI enables living, adaptive planning where scenarios evolve continuously as conditions change.

Conclusion

Strategic planning sets the course. Budgeting provides the map. Forecasting gives you the weather. But scenario planning shows you how to steer when conditions change.

By identifying the key levers that drive your business and anticipating the likely scenarios when you pull them, you transform planning from a static exercise into a dynamic capability. And with the power of AI to simulate outcomes at scale, businesses can move from reactive firefighting to proactive, confident decision-making.

In a volatile world, that capability is not a luxury. It is survival.